Unlock a world of financial empowerment with Intuit Credit Karma, offering a suite of tools designed to help you outsmart the system and take control of your financial well-being.

Key Features of Intuit Credit Karma

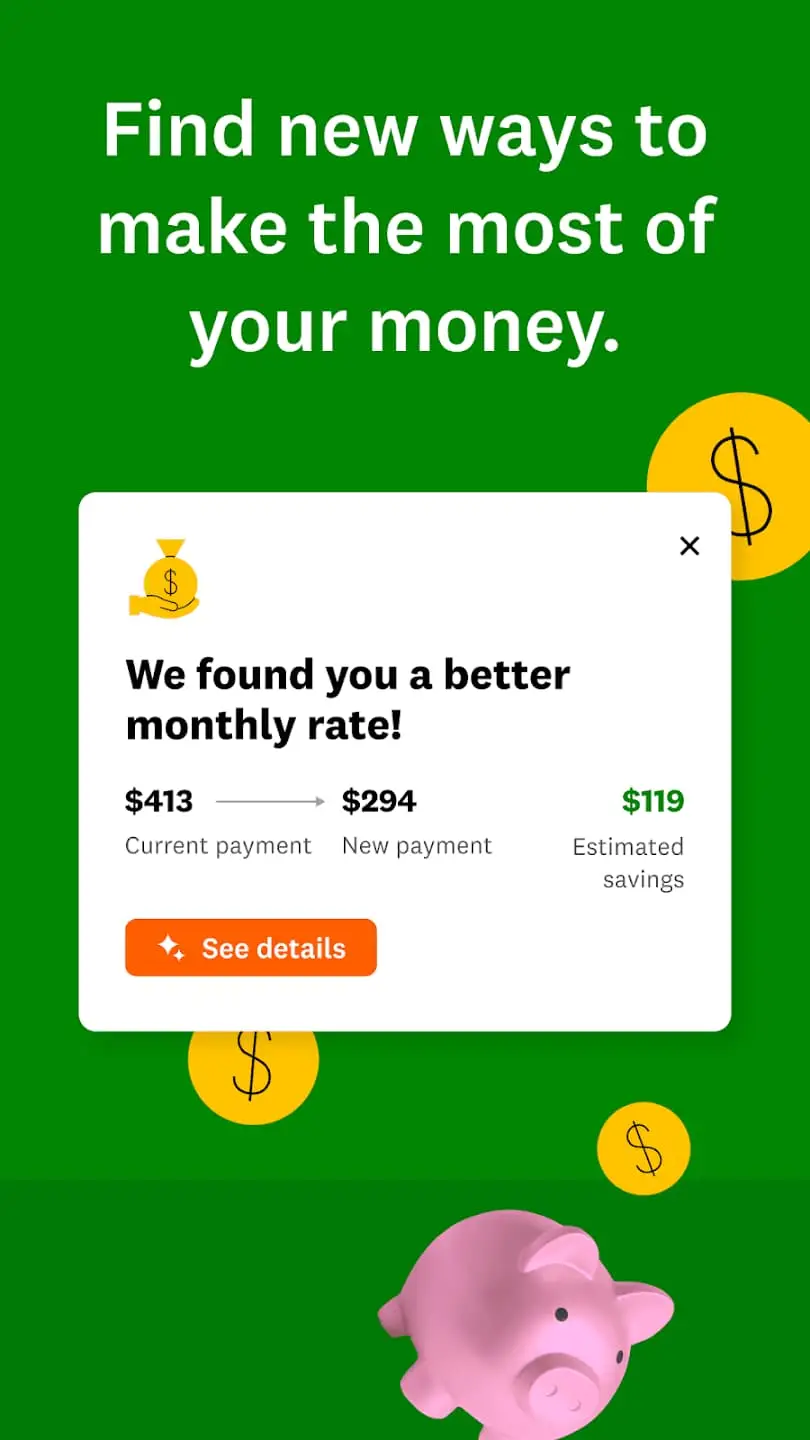

- Insights: Consolidate all your linked accounts effortlessly and gain valuable insights to enhance your financial strategies.

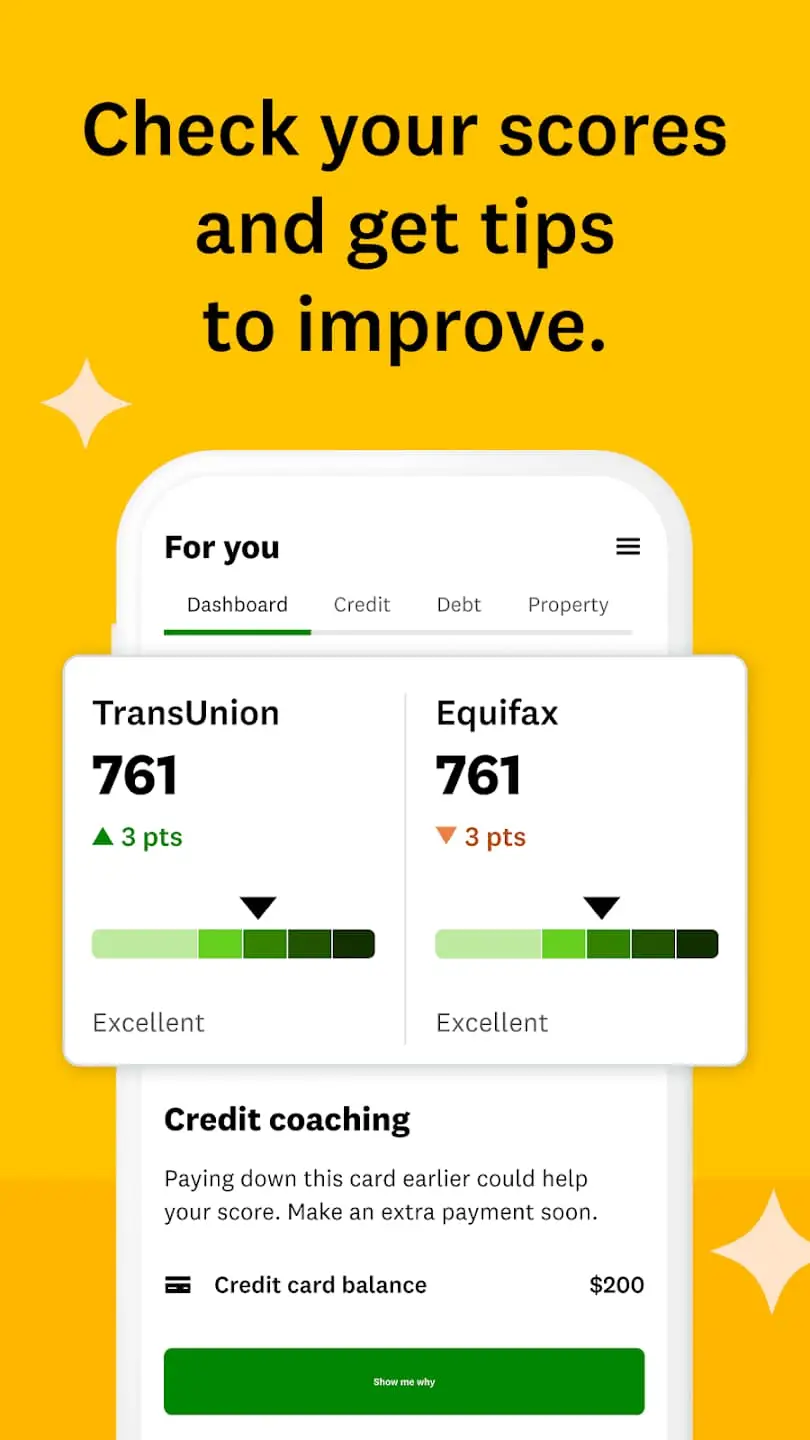

- Free Credit Monitoring: Stay informed with instant alerts on score changes, comprehensive credit score breakdowns, and actionable tips for improvement.

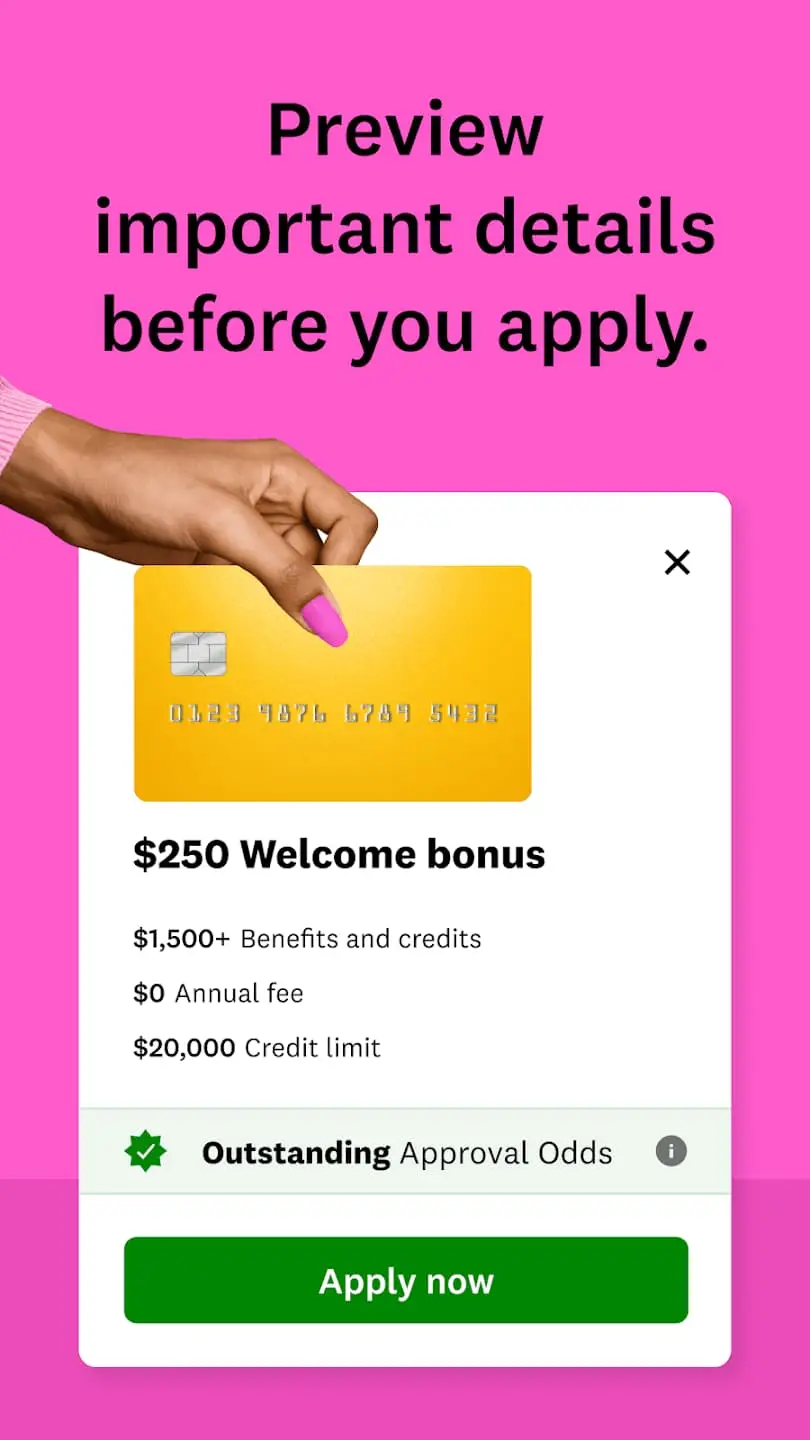

- Advanced Cards and Loan Marketplace: Explore tailored credit card and personal loan offers, complete with specific credit limits, exact loan amounts, and rates for potential approval.

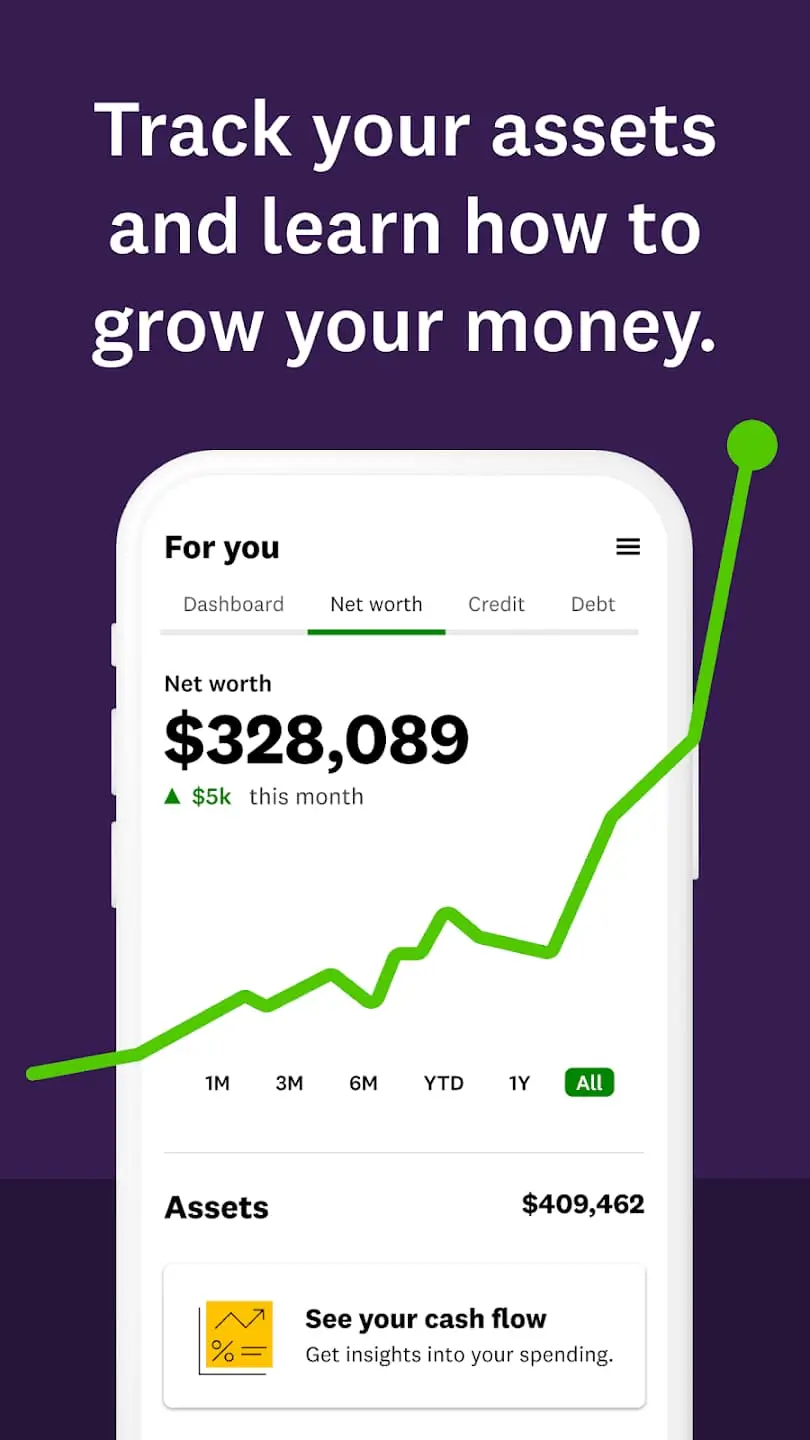

- Net Worth Tracking: Monitor your net worth, categorize monthly cash flow, identify saving opportunities, and receive guidance for navigating complex financial decisions.

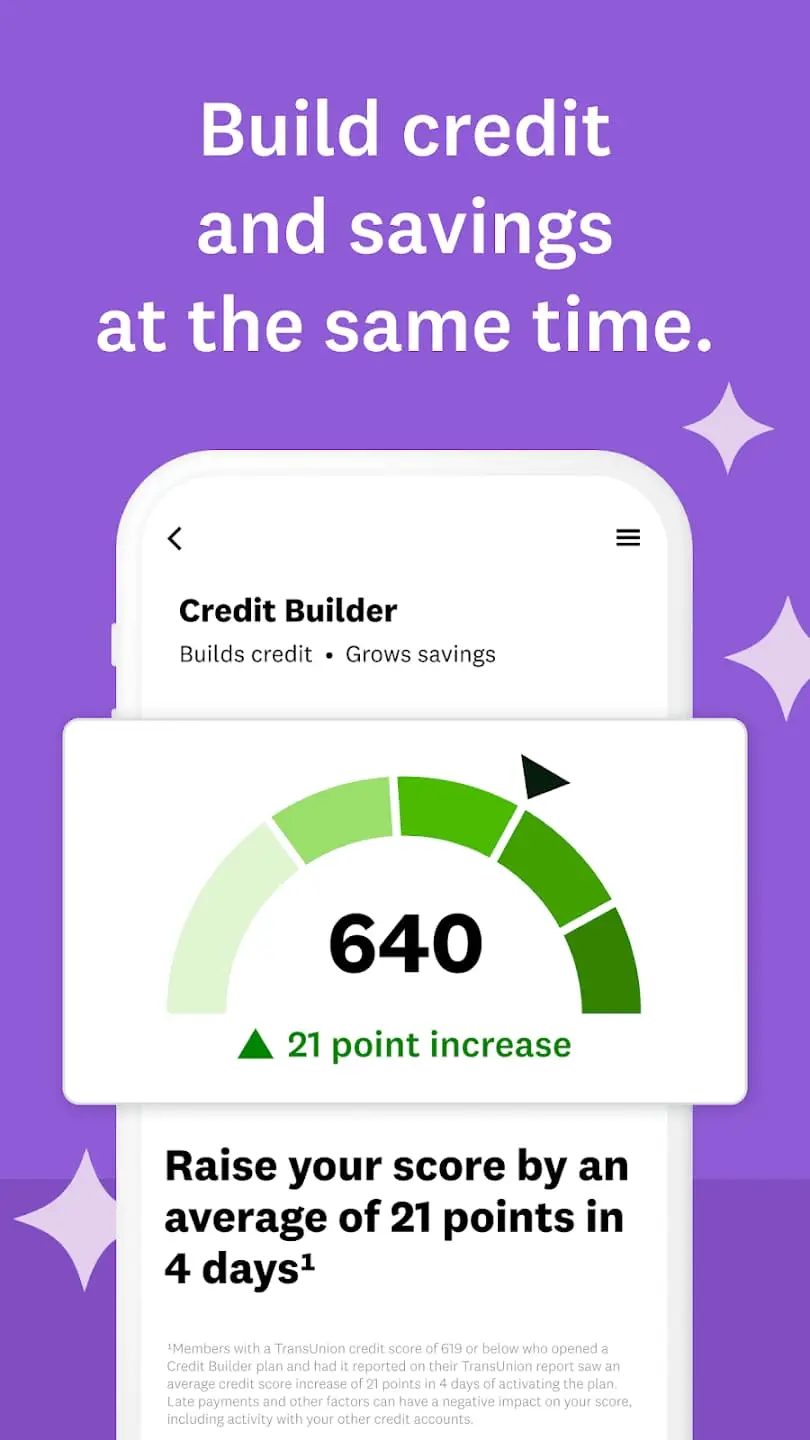

- Credit Builder: Elevate your credit score by an average of 21 points in just four days*, unlocking new financial possibilities.

- Checking with Credit Karma Money Spend™ Account: Optimize your finances by direct depositing your paycheck, potentially accessing funds up to two days earlier**.

- Drive Score: Secure substantial savings on car insurance with a good drive score from a nationally trusted provider.

Additional Details and Disclosures

- *Banking services are provided by MVB Bank, Inc., Member FDIC. Credit Builder is not provided by MVB Bank.

- **Credit Builder plan, serviced by Credit Karma Credit Builder, requires a line of credit and savings account provided by Cross River Bank, Member FDIC. Users with a TransUnion credit score of 619 or below saw an average increase of 21 points in 4 days after activating the plan.

- ***Early access to paycheck is subject to payor submitting payroll information before the release date. Maximum balance and transfer limits apply.

- Loan services offered through Credit Karma Offers, Inc., NMLS ID# 1628077. Check licenses at Credit Karma Loan Licenses. California loans arranged pursuant to a California Financing Law license.

- Insurance services offered through Karma Insurance Services, LLC, CA resident license #0172748.

Eligibility and Additional Details for Personal Loans

- Personal loan offers on the Credit Karma marketplace are from third-party advertisers, with rates ranging from 5.4% APR to 35.99% APR and terms from 12 months to 7 years.

- Rates are subject to change by third-party advertisers.

- Other fees may apply, such as origination fees or late payment fees, depending on the particular lender. Refer to the lender’s terms and conditions for details.

- All loan offers require application and approval by the lender, with qualification varying among applicants.

Credit Karma offers a wide range of features beyond what’s listed here. Download the app today and unlock a world of financial possibilities!