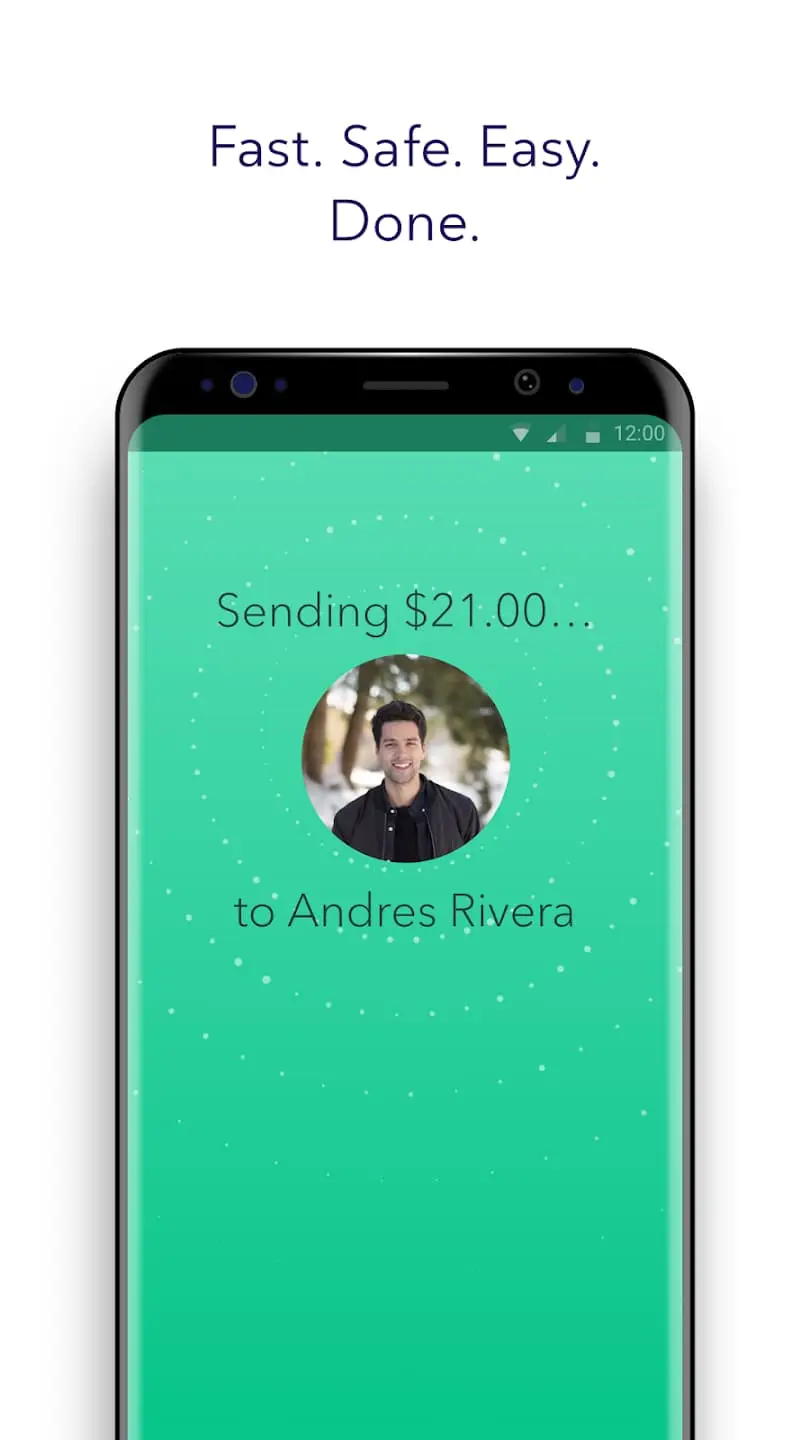

Experience fast, safe, and effortless money transfers with Zelle®! In partnership with leading banks and credit unions across the U.S., Zelle provides a seamless way to send money to friends and family directly from your bank account to theirs. If your financial institution supports Zelle, you can access it through your mobile banking app or online banking. For those without direct access, the Zelle app simplifies money transfers to enrolled users.

Key Features of Zelle

- Fast Money Moves: Send money quickly and securely from your bank account to the recipient’s account.

- Bank and Credit Union Partnerships: Zelle has partnered with major banks and credit unions nationwide for widespread accessibility.

- No Fees: Enjoy the convenience of Zelle without incurring any additional fees. (Note: Mobile carrier or bank fees may still apply).

How to Get Started

- Download Zelle App: Get started by downloading the Zelle app.

- Enroll with Debit Card: Link your U.S. checking account to the Zelle app using a Visa® or Mastercard® debit card.

- Enroll with Online Banking: Alternatively, enroll your U.S. checking account using your online banking username and password, if supported by your bank.

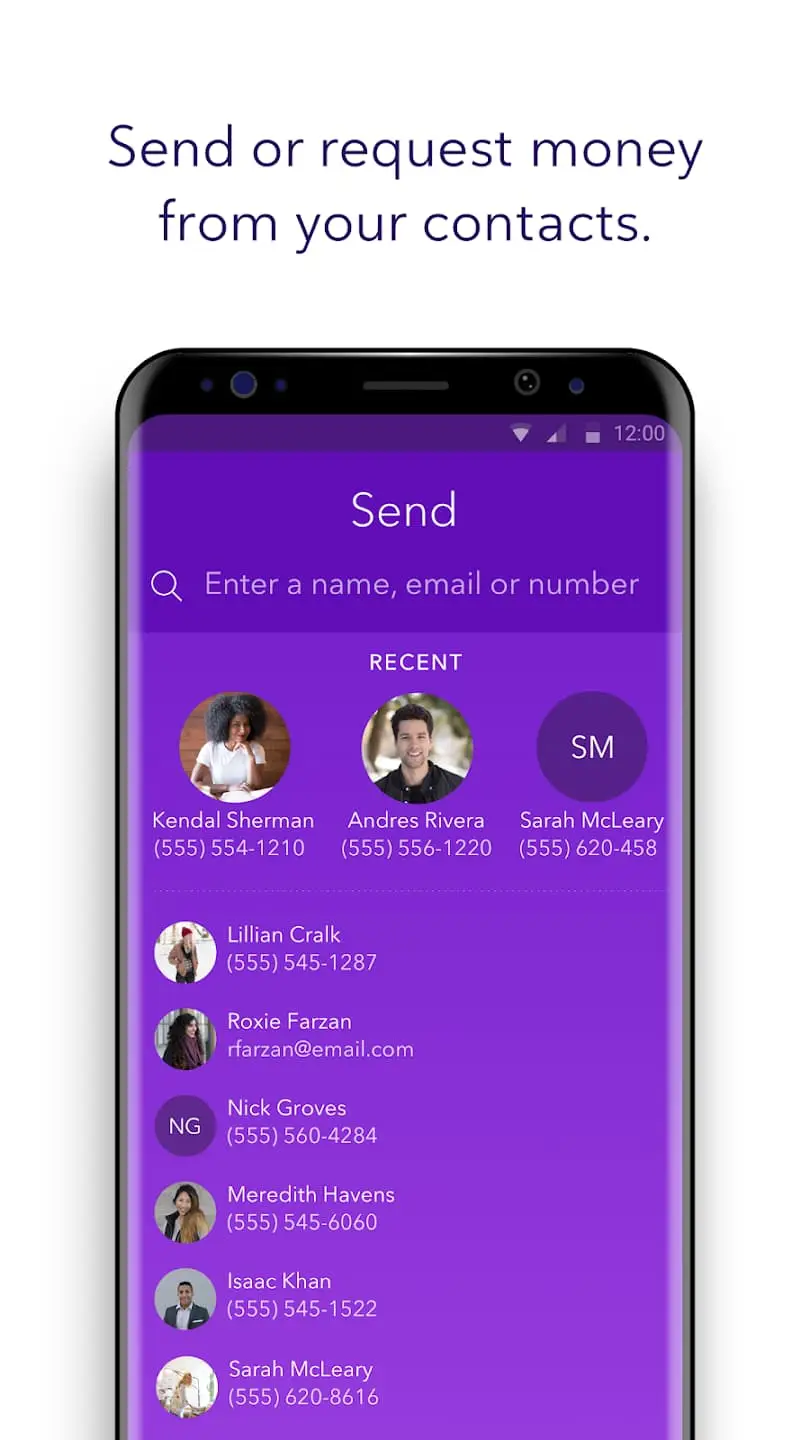

- Select Recipient: Choose a recipient by entering their U.S. mobile number or email address.

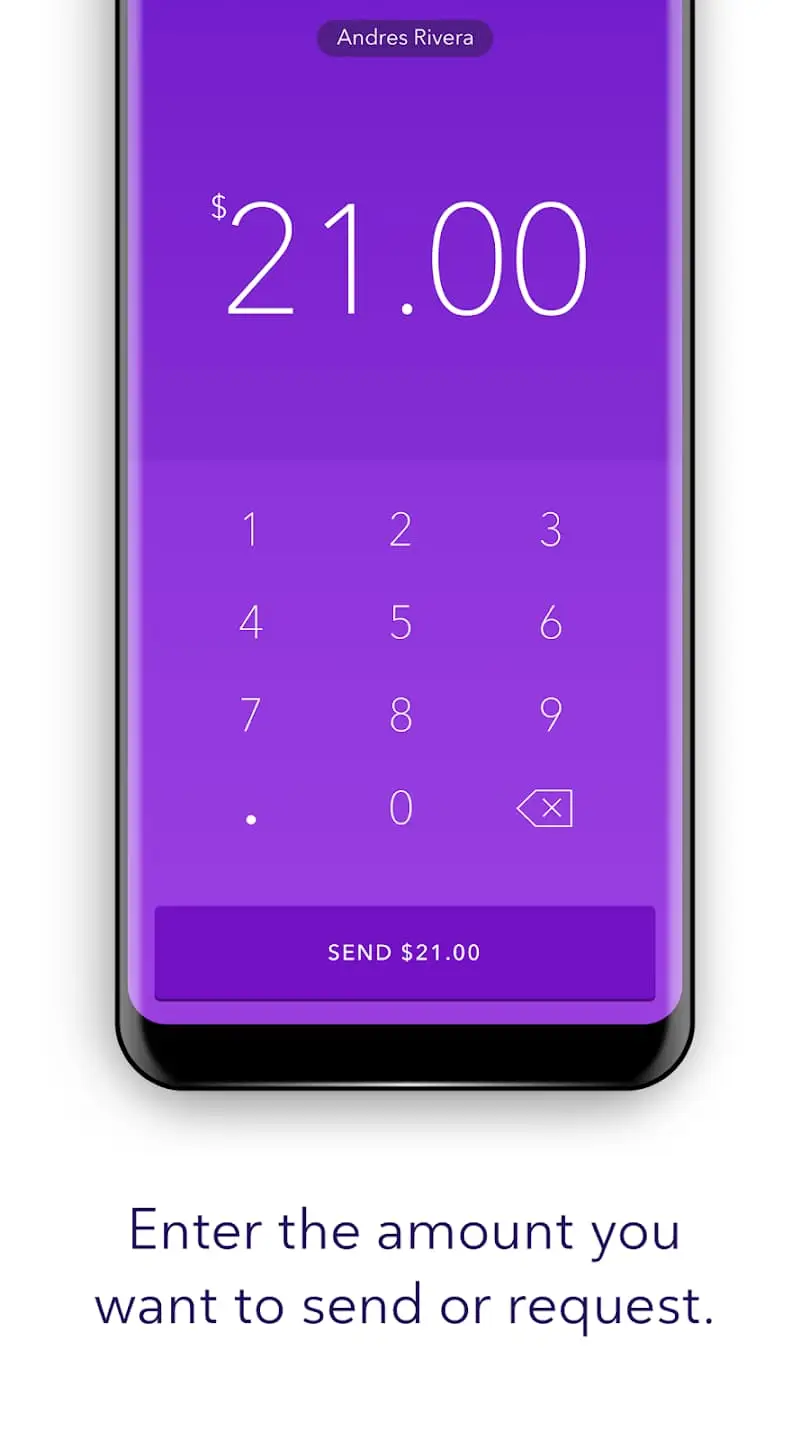

- Confirm and Send: Confirm the amount and hit send. If the recipient is already enrolled with Zelle, they’ll receive the money within minutes. If not, they’ll be notified and can easily complete the payment.

Benefits of using Zelle

- Fast: Money typically moves from one bank account to another within minutes.

- Safe: Uses bank-level security measures to protect your information.

- Easy to use: Only requires the recipient’s email address or US mobile number.

- No fees from Zelle (though mobile carrier or bank fees may apply).

Zelle seems like a valuable tool for anyone who needs to send or receive money quickly and easily within the US. Click to this link below yto download the app faster.